A venture studio is an established organization that creates multiple startups either directly from ideas developed internally by the studio or by partnering with talented entrepreneurs that have an existing idea. They are often founded by serial entrepreneurs who want to make a deeper impact on a specific sector of the market through a portfolio of startups, rather than focusing on a single effort. Studios provide an initial team, strategic direction, shared services, and capital for the portfolio of startups and quickly decide which ones have the potential to succeed in the market.

Venture studios are NOT accelerators and NOT incubators. They are founders of multiple startups. Because of their role in idea formation, validation, and startup development, studios act as both founders and investors of startups. They generate outsized economics through common founders shares as well as preferred equity, typically driving 30-60% ownership in the companies they create. This is one of the only asset classes that allows LPs and investors to benefit from founder ownership, which is an important differentiator from traditional venture.

Venture studios came into existence in the 1990’s with Bill Gross and IdeaLab. Since then, there has been an enormous expansion of the category from talented founders. One example is Atomic Labs, founded by Jack Abraham, who launched Atomic after exiting his startup, Milo, to Ebay. Atomic is responsible for the successful creation of HIMS, Bungalow, and Terminal as examples. Each of these startups have driven upwards of 100x invested capital for the studio. This is just one example of the power of venture studios. Venture Studios are a more vertically integrated approach to launching new companies when compared to traditional venture capital.

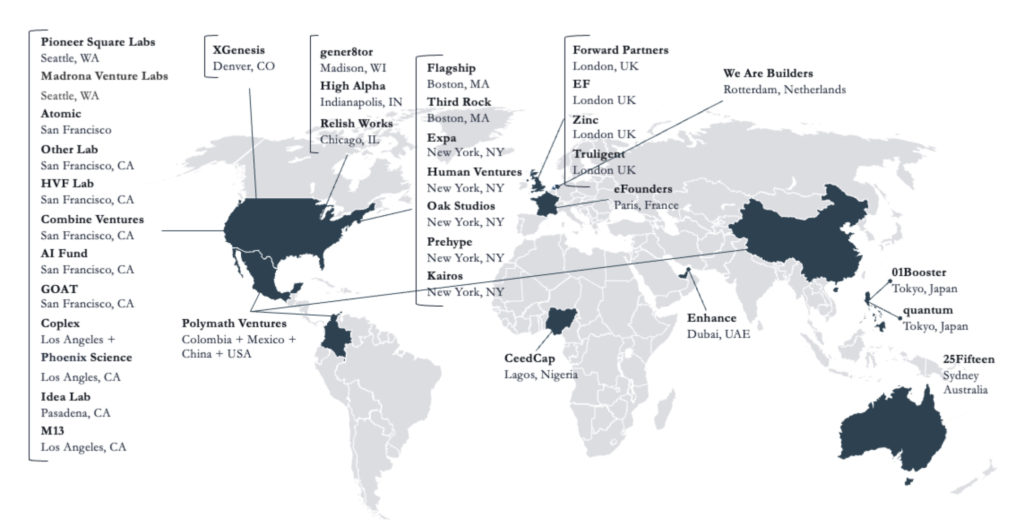

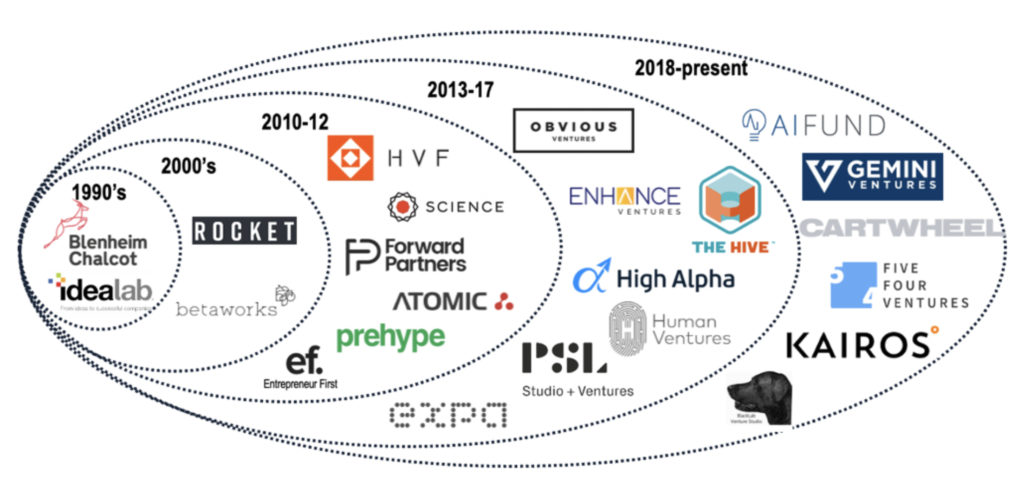

The venture studio market is still emerging. While there are currently over 350 venture studios around the world, many of them were formed after 2013 and the impact of inception level ownership is just beginning to be seen by recent exits. This creates strong opportunities for investors that have early insight into the factors that are driving success in this space.

Types of Venture Studios

For purposes of this analysis, we consider three types of venture studios: formation studios, commercialization studios, and early-stage incubators. While early-stage incubators can be considered a type of venture studio, there are several drawbacks to the model, and they are not considered a target for Vault Fund.

Formation Studios. Formation studios create ideas and companies internally. The partners of the studio are the initial founders of each company the studio creates. They provide significant control and influence over company development. These studios typically excel within specific categories such as consumer products, enterprise saas, or digital health. This model includes Atomic Labs, The Hive, Gemini, and IdeaLab. This structure generates higher average ownership levels and better overall economics than traditional venture.

Commercialization Studios. Commercialization Studios selectively identify promising data and IP from research institutions and license it to conduct further testing and potentially launch new companies. This model is primarily applied in therapeutics, ag tech, and deep tech, where robust research is necessary to get to early proof points. Commercialization studios benefit from not having to bear the cost of early data and validation conducted by the research institution. They also benefit from favorable licensing terms and long-term relationships with the institutions that have the best data and IP. Examples of commercialization studios include Atlas Venture, Third Rock, and Flagship Pioneering. This model is less prevalent, but also results in strong ownership (generally between 40-80% initially) and control over exit pathway and follow-on terms.

Early-Stage Incubators. Early-stage incubators usually find or recruit external founders with an existing idea and bring them in to provide shared resources, insight, and capital. This model is less attractive due to the lower ownership profile (generally 10-20%), which makes it look much more like a traditional venture fund. In addition, early-stage incubators have less control over the subsequent funding rounds due to their marginal ownership, and typically do not provide access to founder’s-level equity.

**Note: many studios employ different types of company creation, incubation, and commercialization. Studios are rarely purely one type or another.

Market Landscape

There are approximately 350 startup studios around the world, as of December 2019, according to a report published by Enhance Ventures. The growth of the studio category is accelerating with >50% launched in the last 5 years due to the increasing attractiveness of the studio model. This is largely driven by three factors: serial entrepreneurs with interest in creating more, diminishing cost of startup formation, rise of the gig economy and increasing access to and flexibility of tech talent. Many of these studios executed on a combined strategy of internal idea formation and external founder recruitment, making them a mix of formation fund and early-stage incubator (as described above).

There is strong growth in studio formation internationally, especially in emerging markets where talent and capital are more dispersed. Studios can provide early support infrastructure (talent and capital) to get startups from concept to company in environments where there is less support of promising ideas and budding talent.

Of these 350 or so, there is a growing body of leading studios that have been driving newco creation for several years and have developed a track record for returns. Examples of these tenured studios include Idealab, Rocket Internet, Betaworks, HVF, eFounders, Prehype, Atomic, Pioneer Square Labs, The Hive, and High Alpha. There is also a long tail of talented founders creating new studios in interesting areas. Many of these new studios are being created by serial entrepreneurs, who want to scale their build efforts across a portfolio of companies.

Industry Performance

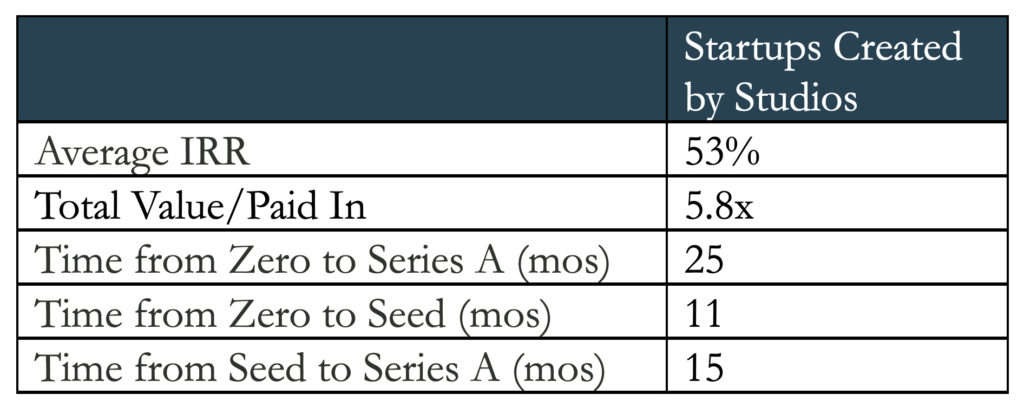

Studios are able to drive higher returns faster. As the venture studio category continues to evolve, early data is showing strong performance. The Global Startup Studio Network, GSSN, recently came out with an industry report providing compiled data from studios(1):

This report also indicated that 84% of startups created within a studio graduate to an institutional seed round and 72% make it from seed to Series A, resulting in 60% of startups making it from inception to successfully raising a Series A round.

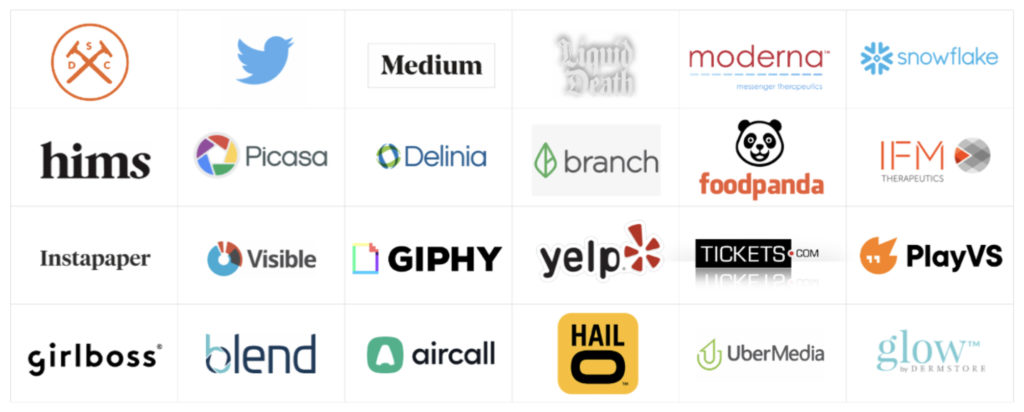

Many successful companies have either already exited or are showing incredible growth within the studio environment. Below are some examples of companies that have emerged from venture studios or have been developed in a venture studio structure:

Not all venture studios will succeed or perform well. There is a high level of risk in this category, but for those that have early insights, there are strong opportunities with identifiable common denominators for those studios that have proven success.

Source: Internal analysis from a survey GSSN conducted with participation from 258 studio startups. Disrupting the Venture Landscape. Please note: only 14 studios provided IRR and TVPI data. GSSN Whitepaper. November 2020. https://www.gssn.co