2022 has proven to be a difficult year to predict with a hot start to fundraising for both companies and funds, quickly turning into a significant slowing. The slowdown was largely due to macroeconomic pressures around supply chains, inflation, and geopolitical tensions, which produced uncertainty in the public markets. The uncertainty led to some of the largest public market corrections we have seen in more than a decade, causing heavy impact on publicly traded technology companies. The significant declines on public holdings led to an overweighting of private positions, which take longer to mark down.

During this market turbulence, we’ve seen an unexpected rise in the number of new company creation funds and venture studios coming online. The private market unrest has provided an opportunity for operator talent to create new entities and innovations. Ideation and early company creation require minimal capital resources, an advantage in markets like this, where capital is constrained. Bill Gurley, a storied venture capitalist with Benchmark, recently released a blog post noting that now is the best time in 15 years to start a new company.

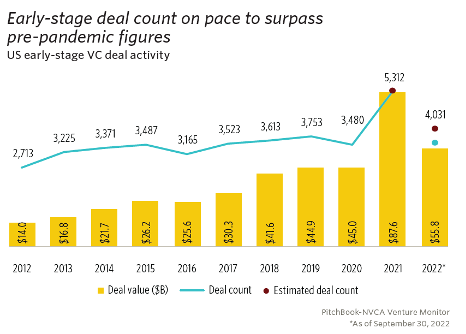

The outlook for 2023 is difficult to predict, but there are early indications that the US federal reserve rate hikes are curbing inflation. While there has been a significant decrease in deal counts and deal value across all stages of venture, metrics have not fallen below pre-pandemic figures, as illustrated below. The metrics below show that 2021 was an anomaly in the growth of venture capital activity, and the larger picture should not be ignored. Even in a year of uncertainty and significant macro pressures, venture capital activity remained strong relative to historical figures, part of a durable, positive trend in the industry.